When a fixed asset ie. C the asset is fully depreciated.

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting

Further normal wear-tear obsolescence natural factors and other such factors lead.

. It proves to be a prerequisite for analyzing the businesss strength profitability scope for betterment. The tax base of an asset is the amount that will be deductible for tax purposes against any taxable economic benefits that will flow to an entity when it recovers the carrying amount of the asset. When a financial asset at FVPL is reclassified as FVOCI the new carrying amount is equal to Date of record It is the date on which the stock and transfer book of.

When a financial asset at FVPL is reclassified to FVOCI the new carrying amount is equal. Eliminate the accumulated depreciation against the gross carrying amount of the newly-revalued asset. Assets cost less accumulated depreciation.

An item of property plant and equipment is acquired it is recognized at its historical. An assets book value is equal to its carrying value on the balance sheet and companies calculate it by netting the asset against its accumulated depreciation. Present value of expected cash flows.

The carrying amount is equal to the cost of the asset less the accumulated depreciation. Net Book Value represents the carrying value of an asset that is equal to the value after deducting depreciation depletion amortization andor accumulated impairment to date. When the sum of the assets accumulated depreciation accumulated impairment Josses and residual value is equal to its cost d.

It equals the original cost or revalued amount of the asset minus accumulated depreciation and accumulated impairment loss if any. Blue-book amount relied on by secondary markets. If the economic benefit will not be taxable the assets tax base will be equal to its carrying amount.

Assets fair value less its original cost. Present value of contractual cash flows d. B no gain or loss on disposal is recorded.

False Revenue results when there is an increase in a liability or a decrease in an asset. If the carrying amount of an asset equals its selling price at the date of sale then a a gain on disposal is recorded. Question 10 1 point The difference between a depreciable assetes cost and its residual value is called the annual.

Original carrying amount c. Assets cost less residual value. When the assets carrying amount is equal to its residual value c.

An assets tax base is the amount that will be deductible for tax purposes in future periods once the economic benefits of the asset have been realized and a company can recover its carrying amount. On the other hand the recoverable amount of an asset refers to the maximum amount of cash flows Cash Flows Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. Question 51 The carrying amount of an asset is equal to the a.

Assets cost less residual value less accumulated depreciation. If it is not taxable the tax base and the carrying amount of the dividends receivable are equal. A corporation has Bonds Payable of 3000000 and Unamortized Discount on Bonds Payable of.

Fair value at reclassification date b. The assets acquisition cost less the total related amortization recorded to date. If these profits will not be taxable the tax base of the asset is equal to its carrying amount IAS 127.

The carrying amount of an intangible is. Your account books dont always reflect the real-world value of your business assets. Meaning and Formula.

The associated account Accumulated Depreciation has a credit balance of 43000. The carrying amount of a depreciable asset is always equal to its actual value because depreciation is a valuation technique. The Tax Base of.

When the assets carrytng amount is zero b. Assets cost less accumulated depreciation. It is the value at which an asset is recorded in the balance sheet of an enterprise.

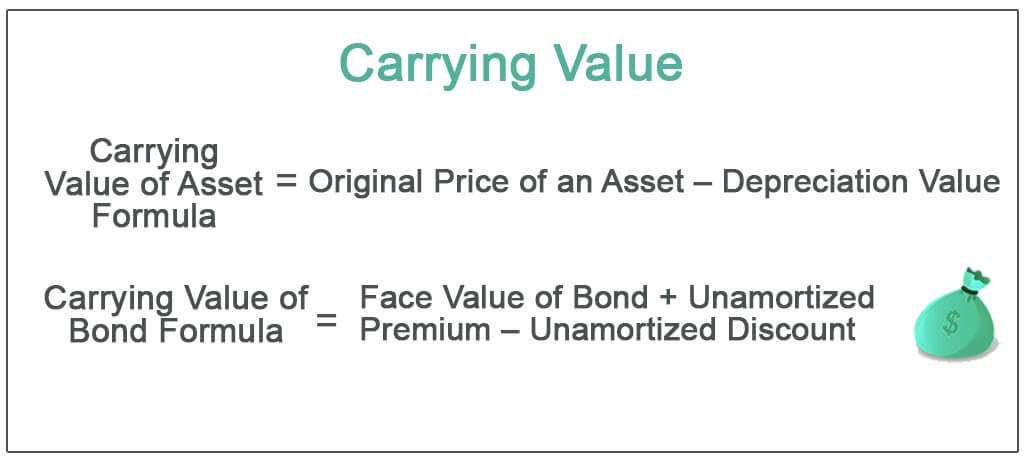

Carrying value of a fixed asset also called book value is the amount at which a fixed asset is appears on a balance sheet. If the economic benefit will not be taxable the tax base of the asset will be equal to the carrying amount of the asset. Transcribed image text.

Replacement cost of the asset. A company has a truck that has its cost of 50000 in its account entitled Truck. The carrying amount or carrying value of the receivables is 81000.

The fair value of the asset at a balance sheet date. If the carrying amount of an asset equals its selling. Question 9 1 point The carrying amount of an asset is equal to the assets fair value less its original cost.

Carrying amount and market value differ in many ways as listed below. Equal to the balance of the related accumulated amortization account. The market value of an asset on the other hand depends on supply and demand.

See examples given in paragraph IAS 127. The carrying value of an asset means its book value. These factors may not reflect what the asset would sell for.

The assessed value of the asset for intangible tax purposes. An example is dividends receivable from a subsidiary. The trucks carry amount or book value is 7000.

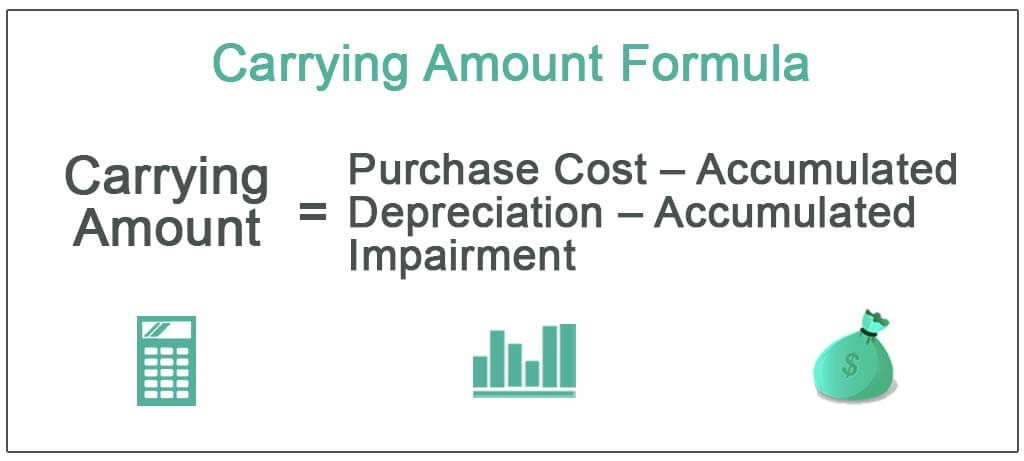

This method is the simpler of the two alternatives. Carrying amount is the value of an asset as it appears on the balance sheet and is acquired after deducting its accumulated depreciation and impairment expenses. Assets cost-plus residual value less accumulated depreciation.

The carrying amount is the original cost adjusted for factors such as depreciation or damage. Force the carrying amount of the asset to equal its newly-revalued amount by proportionally restating the amount of the accumulated depreciation. Which statement is true when a financial asset at FVOCI is reclassified to FVPL.

The carrying value of an asset is the figure you record in your ledger and on your companys balance sheet. A liabilitys tax base is the carrying amount of the liability less any.

Carrying Amount Definition Formula How To Calculate

Carrying Value Definition Formula How To Calculate Carrying Value

0 Comments